Publicaciones en tendencia de Hogar y estilo de vida

Inspírate con contenido en tendencia sobre home & living en redes sociales.

Jan 15

Rose City Counter-Info, the Portland Antifa blog that organized the attempts to crash aircraft over the ICE facility last year using lasers, has announced a direct action at the family home of a Portland woman they accuse of being an ICE agent. "It’s time to turn it up a notch." They're telling comrades masks are required, no cameras, and to leave phones at home. The attack is being organized as revenge for Renee Good and the two violent Tren de Aragua suspects who were wounded in Portland. https://t.co/eruxyD5BQB

95K

4K

233

2K

9K

442

25

9

Jan 15

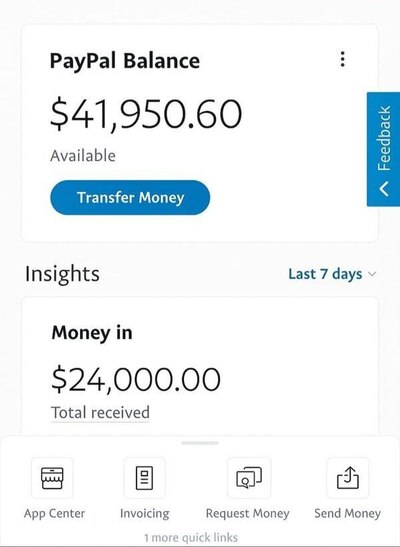

🚨 Google pays $150/hour for work-from-home tasks 📱 No office. No experience. No Skill. Just your phone + internet. Most people don’t know this exists. I’ll explain how it works step-by-step 👇 To get it : 🔁 Retweet and Follow 💬 Comment "SEND" (Retweet and Follow mandatory to get instant DM)

43K

561

488

342

Jan 15

Redefine breaking and entering in Mansion Raid. Infiltrate a luxury property and make a multi-stage descent to the basement vault to extract the gold — or fend off the would-be infiltrators as defenders in this new high-octane GTA Online mode: https://t.co/9OOopVn4hs

224K

2K

194

195

Jan 15

TAX MAN: Hey you! Your W-2 is ready. Pumped for tax season. ME: Awesome, so I can file my taxes now? TAX MAN: Nope, your wife’s W2 isn’t ready yet. ME: Cool. I'll see if she knows her ADP login. TAX MAN: Hey. Your 1098 is ready. ME: Great, that’s my mortgage interest right? TAX MAN: Yep. But your loan got sold last year haha. So you’ll get two 1098s, one from each bank. ME: Yea I remember getting a letter about that at some point…that's like the 3rd time our mortgage has been sold. TAX MAN: Btw only 1 of your 1098s is ready. The other isn't. ME: Cool, so I still can't really file yet. TAX MAN: Yep. But your brokerage account 1099s will come out in mid-Feb. TAX MAN: Go look for a Consolidated 1099, or separate 1099-INT, 1099-DIV, 1099-B, 1099-R. ME: I thought 1099s were for people who were contract-based employees or gig workers? TAX MAN: Nah, 1099s are for so many things man. TAX MAN: Did you sell RSUs last year? If so, you'll get a 1099-B that shows $0 basis, so you'll want to go get a Supplemental Information document from your broker. ME: Cool, thanks for the heads up. Someone will tell me that explicitly, right? TAX MAN: Not at all. ME: Cool. What’s the difference between 1099-MISC and 1099-NEC? TAX MAN: 1099-NEC (Non-Employee Compensation) reports payments to contractors. 1099-MISC (Miscellaneous) reports other types of payments like rent, royalties, and prizes, etc. TAX MAN: They changed it a few years ago but didn't really tell anyone. ME: Why are you the way you are? TAX MAN: Nobody knows. ME: Looks like I got a 1099-K this year? TAX MAN: Did you sell something online? ME: I sold a couch on Facebook Marketplace TAX MAN: For how much? ME: $600... TAX MAN: Congratulations, you’re a business now. ME: Okay I have all my 1099s, I’m ready to file. TAX MAN: Did you check for corrected forms? ME: What? TAX MAN: Sometimes they prepare a corrected one to recharacterize income or fix mistakes. TAX MAN: They come like a few weeks later. ME: So should I wait? TAX MAN: Up to you man. TAX MAN: File now and maybe amend later? TAX MAN: Or wait, and maybe it never comes. ME: Cool. ME: Oh btw, I invested in a private company last year. TAX MAN: Ah, you’ll be getting a K-1 now LOL. ME: Great, when? TAX MAN: LOL. ME: Taxes are due in a couple months... TAX MAN: Right. ME: But the form comes in October? TAX MAN: Sometimes September if you’re lucky! ME: So what do I do? TAX MAN: File an extension and make a payment. ME: I filed an extension, but I think we owe money. TAX MAN: Yeah you'll need to pay that by 4/15. ME: But I don’t know how much I owe? ME: Because I don’t have all my forms... TAX MAN: You estimate. 100% of last year's tax or 90% of this year's tax....or else you get slapped with thousands in underpayment penalties/interest. ME: What if I make over $150,000? TAX MAN: Then you have to pay in 110% of last year's tax....or 90% of this year's tax. ME: What if I estimate wrong? TAX MAN: Penalty. ME: What if I overpay? TAX MAN: They’ll refund it eventually. ME: With interest? TAX MAN: LOL no. ME: I did everything right. ME: I have all my forms ME: I filed on time ME: I’m getting a refund TAX MAN: Congratulations ME: When will I get it? TAX MAN: The IRS says 21 days TAX MAN: It’s been 12 weeks TAX MAN: Your return is “still being processed”. ME: Can I call someone? TAX MAN: You can try. TAX MAN: They’re experiencing higher than normal call volume. ME: For how long? TAX MAN: Since 2019. ME: What if I just don’t file? TAX MAN: Prison. ME: What if I file wrong? TAX MAN: Also prison, but less likely. ME: What if my accountant files wrong? TAX MAN: Still your fault. ME: Can I just move somewhere with no income tax? TAX MAN: You can try! ME: What if I leave the country? TAX MAN: You still have to file. TAX MAN: For ten years after you renounce citizenship. ME: This is tyranny. TAX MAN: That's funny because that's actually how this whole thing started.

834K

9K

239

1K

27K

1K

54

65

11K

167

114

46

Jan 15

Rooted in memory, propelled by state-of-the-art design The first look at our new home https://t.co/ceI14Tqs3z

5M

24K

1K

4K

Publicaciones en tendencia ilimitadas con Publer

Obtén acceso completo a las últimas publicaciones en tendencia y gestiona todas tus redes sociales con Publer desde solo 4 $ al mes.

Explorar planesDescubre herramientas gratuitas que se recomiendan

Maximiza tu productividad y gestiona tu contenido sin esfuerzo con las herramientas gratuitas de Publer.

Create impactful social media content inspired by trending posts

Transforma las últimas publicaciones en tendencia en contenido atractivo para tu audiencia con Publer.

Programa tus publicaciones en redes sociales

Con un conjunto de herramientas potentes e interfaz amigable, podrás crear, previsualizar, programar y analizar tu contenido en redes sociales con facilidad.

Empieza gratis